Let’s say you want to find the net income of your online retail store for the first quarter of 2020. You can use the formula above to make net profit calculations for any given period, such as a month, quarter, or year. If expenses are more than your company’s revenues, then you have a negative net profit, also known as a net loss. If revenues exceed expenses, then you have a positive net profit. Your net profit can be positive or negative. That means the net income formula can also be expressed this way: Net income = Revenue minus the cost of goods sold minus expenses.Īs we pointed out earlier, revenue minus the cost of goods sold gives you the gross income/profit. Net profit = Total revenue minus total expenses.Īlternatively, you can use the following formula: It is the figure you get after you subtract the total expenses from your total revenue. Like we mentioned above, net profit is the true measure of your company’s profitability.

#REVENUE MINUS EXPENSES HOW TO#

Now that you have a basic understanding of the various financial terms, let’s take a look at how to calculate net income. Revenue is the gross or top-line income figure from which costs are subtracted to find net income. Usually, it is brought from the sales of goods and services to customers.

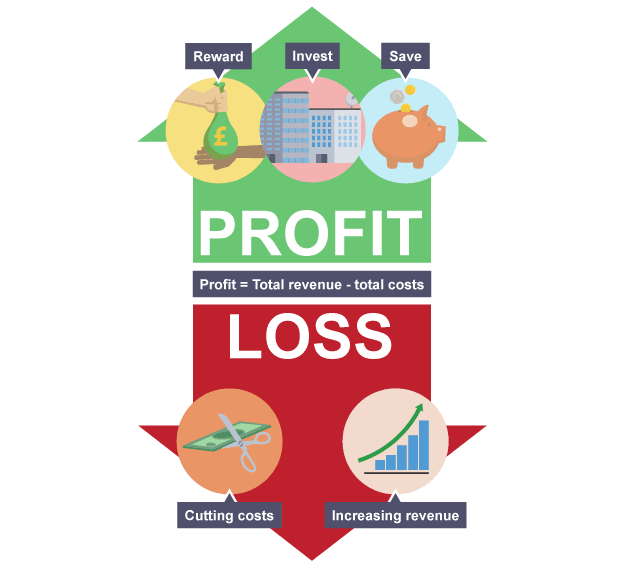

In accounting, revenue is the total income generated from the normal operations of a company over a specified period. If you don’t have any revenue, you don’t have a business. On the other hand, if it is dropping and is no longer sufficient to generate the cash your company needs to keep afloat, you may need to find other sources of funds. If your operating profit is increasing consistently, it signifies a healthy financial growth. Put in other words, it is used to determine your company’s financial stability. It is the primary source of your company’s cash flow, and it depicts your earning power over a specific period of time. Operating profit shows your company’s profits from operations only, without considering income and expenses that aren’t directly related to the core operations of the company. Your business may have various administrative expenses, such as rent, payroll taxes, depreciation, utilities, salaries, insurance, office supplies, etc. Operating profit = Gross profit minus selling and administrative expenses. The cost of goods sold (COGS) includes the amount spent on producing your products or services, including transportation costs (if any). Gross profit = Net sales minus the cost of goods sold, where Net sales = Gross sales minus returns, allowances, and discounts.Īs you can see, gross profit depicts the difference between net sales and the cost of goods sold. In other words, net income shows how efficiently your business is making money. Net income is also known as ‘the bottom line’ since it is the last line of an income statement. Sometimes known as net earnings, net income is used by executives and entrepreneurs as the foundation for creating estimates and long-term business strategies. Some of the expenses you can expect include COGS (selling and administrative expenses), taxes, operating expenses, and interests. In a business context, net profit describes the money you have left after deducting all the expenses from the total revenue. Net profit = Gross profit (plus any other income) minus all business expenses. These terms are found in your company’s income statement, and they express profits related to the different categories of expenses. Types of ProfitĪs a business owner, you should be aware that there are three major types of profit: We also show you how to calculate net income to gain insight into the overall financial health of your business.

This guide introduces you to three fundamental financial terms: Understanding gross profit and net income/net profit calculations will help you assess the profitability of your business – that is, you will know the company’s ability to pay its debts, salaries, and bonuses.

After all, the main objective of a business is to generate profits. Becoming a business owner is a healthy career goal, and when you are ready to venture into the world of being your own boss, it is important to understand what net profit is and how to calculate it.

0 kommentar(er)

0 kommentar(er)